When it comes to allocating investible assets – particularly larger sums of capital – the “where” can be more important than the “why.” I surmise, people who generally earn incomes above the national average may attribute their higher earning capacity as multifactorial by way of → attained skills → acquired knowledge → time allotted →

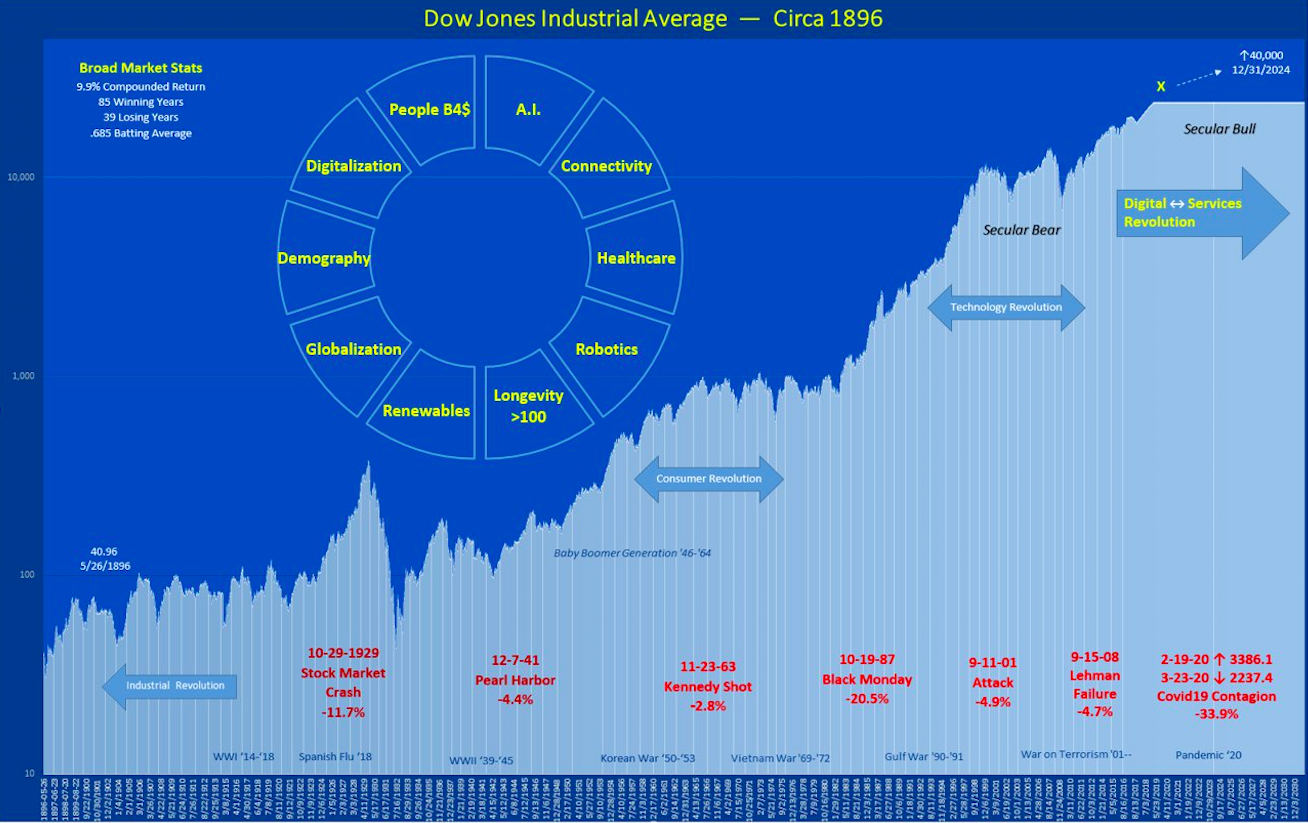

read more MegaTrends