SHORT VERSION — RATES FALL

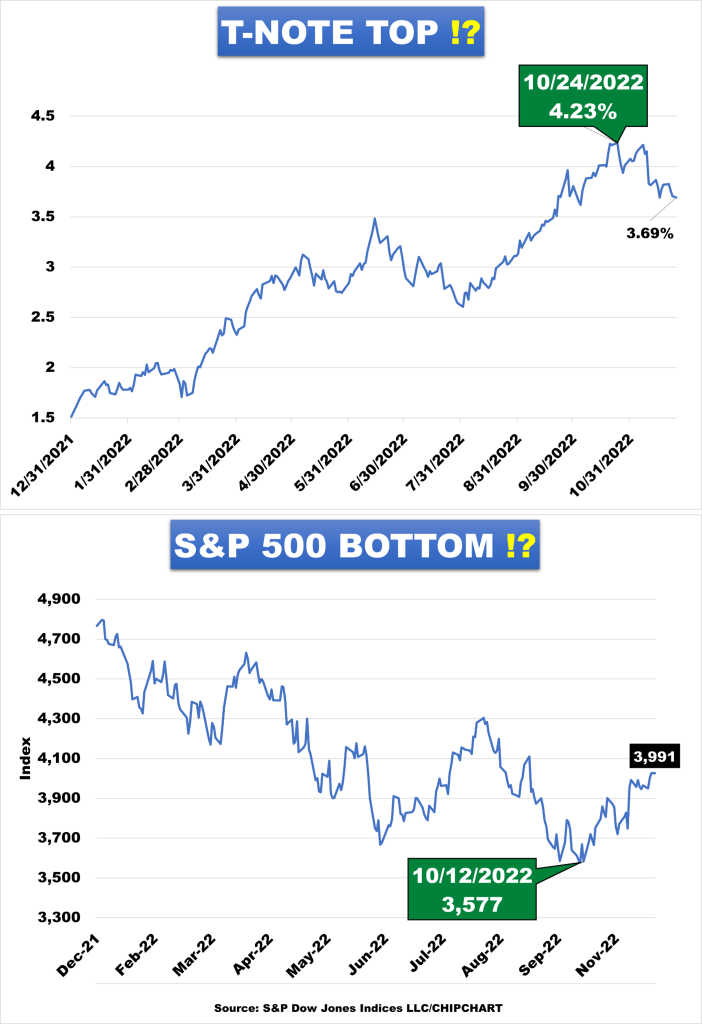

On October 24th, the 10-year treasury note closed at 4.23%. The S&P 500 fell to 3,577 on October 12th. Are these two dates relevant to our economy, homebuyers, savers, and investors? This data can be helpful in making decisions down the road.

LONG VERSION — WHY BONDS

The bond market can be a reliable indicator of the health and direction of the overall economy. By following the bond market, retail investors have an opportunity to gain insight into how markets may be performing in other areas, such as stocks and commodities. This can provide an important edge when it comes to making successful long-term investments.

Short-duration investment-grade bonds and inflation-protected treasuries can provide a degree of safety and stability that lessens the effects of volatility to investors’ portfolios. With bonds, investors can earn a fixed rate of return over the duration of the investment period, thereby helping protect them against sudden losses in stocks due to market instability.

Bonds also have tended to perform well during periods of economic downturns since bond prices rise during periods of declining interest rates. In the past, investors have diversified their portfolios by investing in bonds to protect themselves from sudden economic shocks.

When employed correctly, bonds can be a powerful asset for retail investors. By understanding how they work and keeping up with fixed-income trends, individuals can make wiser choices about where to put their money, thusly improving their probabilities of generating favorable returns.

Additionally, following the bond market is an important way for retail investors to stay up to date on changing economic conditions. By keeping up with developments in this sector, they will have better visibility into potential risks or opportunities that may arise due to changes in global markets and economies.

Published by

Author of Financial Fitness: The Journey from Wall Street to Badwater 135; Public Speaker; Professional Money Manager with 1DB.com.

Disclosure: any views, thoughts, and opinions expressed within this communication contains subjective opinions, and do not reflect the official policy or position of 1st Discount Brokerage, Inc. Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Any examples, outcomes, or assumptions expressed within this communication are only hypothetical illustrations and should not be utilized in real-world analytic products as they are based only on very limited and dated open-source information. Investments involve risk and are not guaranteed. Past performance is no guarantee of future results. Securities offered through 1st Discount Brokerage, Inc., Member FINRA/SIPC. A Registered Investment Adviser.