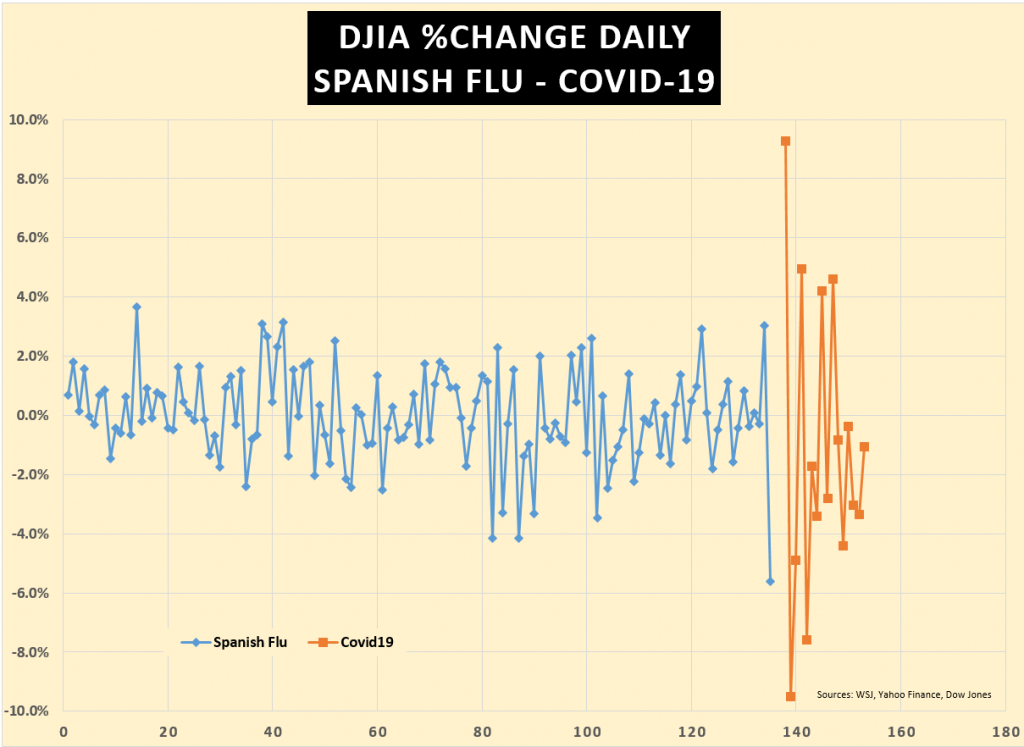

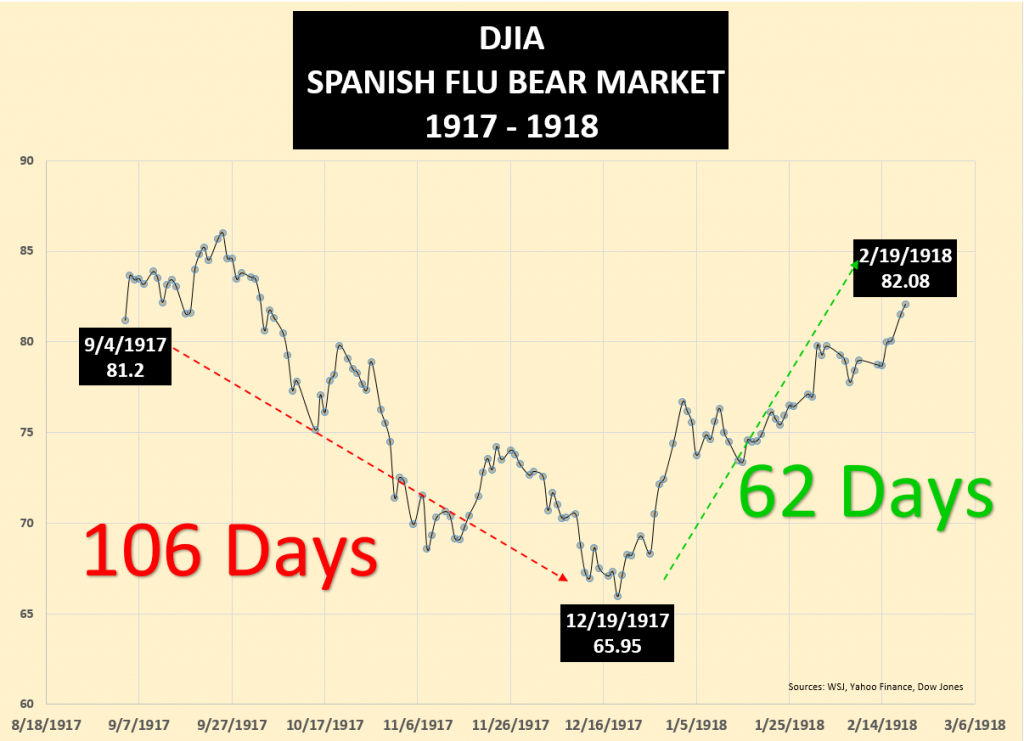

By September 4, 1917, the DJIA fell into bear market territory (-20%), fueled by the Spanish flu pandemic. The first World War killing machine was in full force, tallying millions of casualties among soldiers and civilians. The ill-fated timing of the Spanish flu was more like a curse; the death toll from the sickness amounted to tens of millions. It was a dark period never to be forgotten. Now, we have the coronavirus. Medical experts and unified global leaders sounded a clarion call to warn of the potential perils. I have not seen fear of this kind since the Great Financial Crisis; there is a panic. Volatility is testing the circuit breakers; the bandwidth and scope of the gyrations during this episode ( covid19 – orange line) compared to the Spanish flu (blue line) are daunting. How long can this thick, dense, fear-based anxiety last? Unfortunately, no one knows. What we do know, for sure, is that reality goes on.

From early fall 1917, through mid-winter 1918, the stock market painfully suffered the barrage of bad news; by late summer, the United States would enter a recession. The economic destruction was akin to a Greek tragedy; things could not have been worse. Ten years later, from the 1917 lows, the Dow Jones Industrial Average gained 16% annually, according to dqydj. At the moment, global equities are retesting the lows, plagued by the uncertainty of the virus. Stock market selloffs do not go on forever; they bottom at some point, no one can pick when; then the market rallies, a level that can’t be selected by anyone (except by pure chance). 1db.com offers a Digital Advisory platform that enables savers and investors to invest incrementally, which is systematically and intermittently allocating investable funds as markets ebb and flow over time. This approach has worked quite well for savers for over a century up to February 19, 2020. Is this time different? 1db.com/disclosures/